Key Techniques in Bookkeeping 6318255526

Effective bookkeeping is crucial for maintaining a business's financial health. It requires systematic recording and categorizing of transactions, utilizing technology to enhance efficiency. Automation minimizes errors, while regular audits ensure accuracy. As tax season approaches, strategic preparation is essential for maximizing deductions and ensuring compliance. Understanding these key techniques can significantly impact a business's financial strategy. The implications of these practices extend beyond mere compliance, revealing deeper insights into financial management.

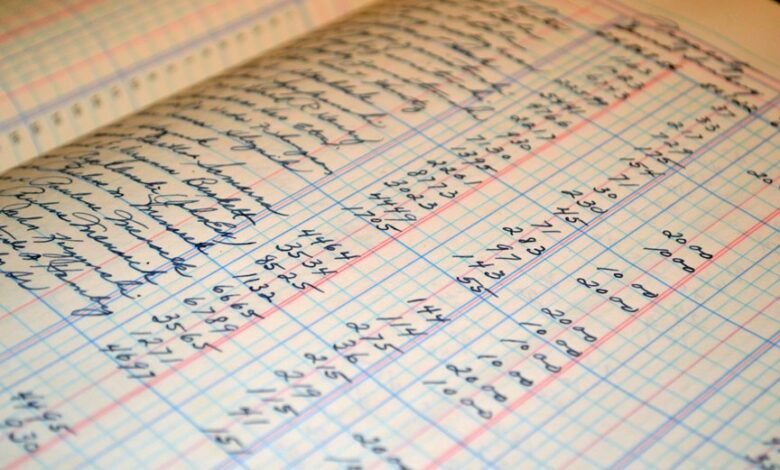

Understanding the Basics of Bookkeeping

Bookkeeping serves as the foundation of financial management, essential for maintaining accurate records of a business's financial transactions.

It involves transaction categorization, which allows for systematic organization and analysis. This process ultimately facilitates the preparation of financial statements, providing stakeholders with clear insights into the company's fiscal health.

Effective bookkeeping empowers businesses to make informed decisions, thereby promoting financial freedom and stability.

Essential Tools and Software for Efficient Bookkeeping

A variety of tools and software are available to enhance the efficiency of bookkeeping processes.

Cloud accounting platforms facilitate real-time access to financial data, enabling remote collaboration.

Additionally, bookkeeping automation streamlines repetitive tasks, reducing the potential for human error and saving valuable time.

Best Practices for Accurate Record Keeping

Accurate record keeping is paramount for businesses aiming to maintain financial integrity and comply with regulatory standards.

Implementing systematic documentation processes ensures data integrity and fosters financial transparency. Regular audits and reconciliations further enhance reliability, while utilizing standardized formats promotes consistency.

Preparing for Tax Season: Key Strategies

How can businesses effectively prepare for tax season to ensure compliance and minimize liabilities? Strategic planning is essential.

Identifying eligible tax deductions can significantly reduce taxable income. Maintaining organized records facilitates timely submissions, adhering to filing deadlines.

Additionally, consulting tax professionals can provide insights into regulatory changes, optimizing financial strategies.

Conclusion

In conclusion, mastering the key techniques in bookkeeping is akin to navigating a vessel through stormy seas. By embracing systematic record-keeping, leveraging technology, and adhering to best practices, businesses can weather financial uncertainties with confidence. As tax season approaches, the importance of organized documentation cannot be overstated; it serves as both a shield against compliance pitfalls and a map to potential savings. Ultimately, these strategies empower businesses to maintain robust financial health and make informed decisions for future growth.